Cardholder Name. (print) Area: Area: Signature: Worker # Date: By signing underneath, I agree that: APPROVING Formal Settlement • I've completed the P-Card On-line Coaching program, and thoroughly have an understanding of all P-Card procedures and procedures. • I will assessment the accounts of all Cardholders for whom I'm liable bi-weekly, and approve or or else adhere to up on all transactions via the 21st of every month. • I will be certain that the following insurance policies and treatments are adhered to by all Cardholders for whom I am accountable: • Cardholders will use the card only for licensed objects, use only licensed retailers, use the cardboard for official District enterprise only and for no personal transactions. • Cardholders will preserve the cardboard safe at all times, and straight away notify US Bank, me (the Approving Official), plus the P-Card Unit of loss, theft, or fraudulent utilization of the cardboard. • Cardholders might be held Individually liable into the District for just about any unauthorized utilization of the cardboard, like -prohibited merchandise/merchants -above-Restrict transactions -personal use -mortgage of the cardboard to every other man or woman for just about any cause • Cardholders will observe reconciliation techniques as explained while in the Procurement Guide, and reconcile through the 18th with the thirty day period.

Credit score can be a guarantee to repay a personal debt for purchases you make. It enables you to acquire anything nowadays and buy it later. Building a great credit historical past will let you purchase a residence or perhaps have a task.

Ideal credit history cardsBest reward supply credit cardsBest stability transfer credit cardsBest vacation credit rating cardsBest income again credit rating cardsBest 0% APR credit score cardsBest benefits credit history cardsBest airline credit score cardsBest college or university student credit score cardsBest charge cards for groceries

Preserving cardholder name information is very important for equally corporations and persons. Applying the next best methods can go a good distance in preserving this sensitive facts protected:

A lot of people make their spouses and associates licensed customers. Some mom and dad might even incorporate their teenagers as secondary cardholders to help them Establish credit rating history and find out how to responsibly use bank cards.

When you transfer amounts owed to another creditor and manage a equilibrium on this credit card account, you will not qualify for future grace periods on new buys so long as a stability stays on this account.

Watch graphs and charts. Acquire included insight into your spending that has a snapshot check out of your funds objectives, averages eventually, plus much more.

The key cardholder who opened the account which is named on the cardboard is only liable for all charges to the account. Authorized users have no legal responsibility.

Currently, Mastercard declared new bank card benefits, working with top overall health & wellness, journey, and Life style manufacturers to assist bridge the hole between everyday essentials and enriching activities.

Dashia Milden Editor Go through more from Dashia Dashia is actually a personnel editor for cardholder CNET Money who addresses all angles of non-public finance, like credit cards and banking. From testimonials to news protection, she aims that can help audience make more knowledgeable decisions with regards to their income.

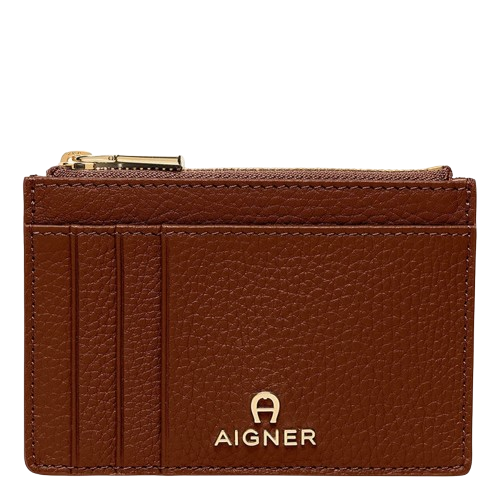

On charge cards, the cardholder name normally appears in the middle of the card, correct underneath the embossed account number.

Your name signifies account possession and identification. Deal with it as an asset! The standardized formats enable avoid fraud universally. Be grateful for that simplicity.

In place of a signature, some cardholders set “see ID” for that merchant to request a photo ID in advance of completing the transaction -- One more fraud avoidance tactic. But these days, it’s exceptional that retailers Look at, particularly when working with contactless payment or EMV chips.

A secondary cardholder is often known as a certified consumer or perhaps a supplementary cardholder. Currently being a secondary cardholder implies that a Key cardholder has offered you entry to their account, which implies you can make buys making use of somebody else’s credit score account.